Taxpayers with three or more children may also be eligible for additional child tax credit regardless of their income. 150000 if married and filing a joint return or if filing as a qualifying widow or widower.

Child Tax Credit What Is The Income Limit For Joint Filers Single Filers And Heads Of Household As Com

It only applies to dependents who are younger than 17 as of the last day of the tax year.

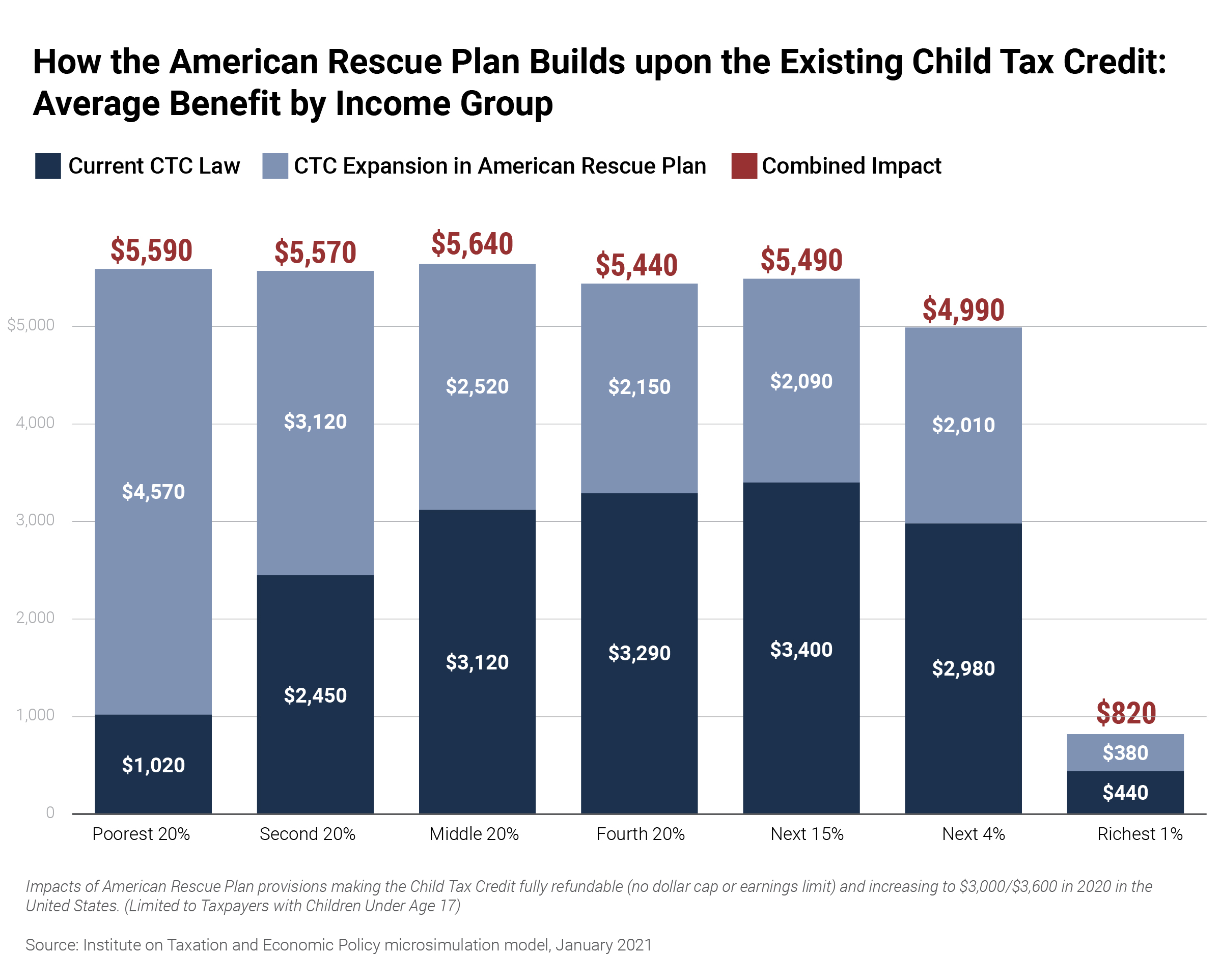

Additional child tax credit 2020 income limit. The existing child tax credit has a rather expansive income limit that favors high incomes as much as low ones. The child tax credit calculator can help you figure out if you are within the income limits and how much you can get back. What Is the Child Tax Credit.

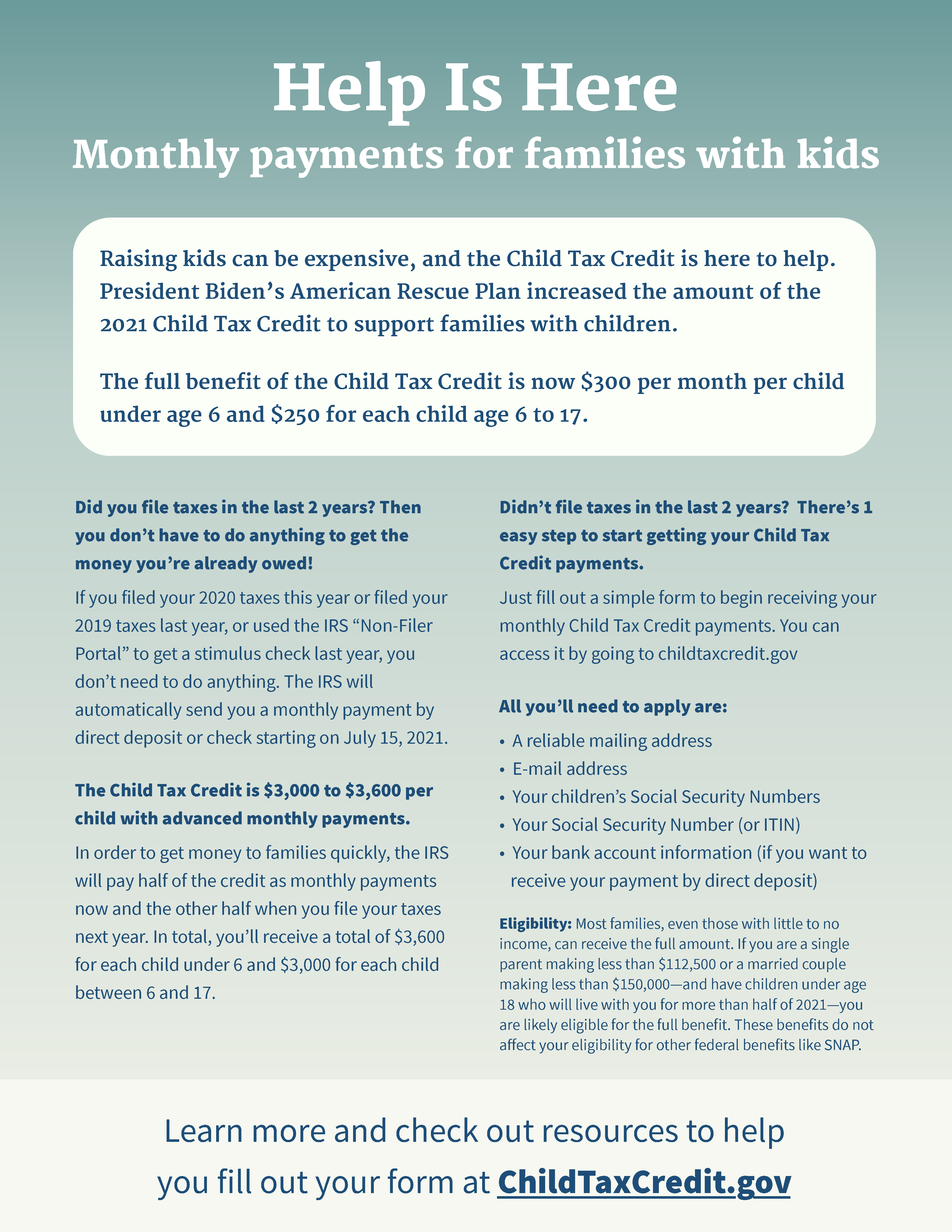

Threshold for those entitled to Child Tax Credit only. Additional Child Tax Credit 2020 Income Limit What is the child tax credit. Previously you needed at least 2500 to qualify for the CTC.

This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it. Tax Year 2020 Income Limits and Range of EITC Number of Qualifying Children For SingleHead of Household or Qualifying Widower Income Must be Less Than For Married Filing Jointly Income Must be Less Than Range of EITC No Child 15820 21710 2 to 538. 2020 to 2021 2019 to 2020.

The credit is worth up to 2000 per dependent for tax year 2020 but your income level determines exactly how much you can get. The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500. The limit for 2020 is 6000 the same as it was for 2019.

75000 if you are. Unlike the Child Tax Credit the Additional Child Tax Credit is calculated off of your earned income. To be eligible for the child tax credit married couples filing jointly must make less than 400000 per year.

For that reason families must have a minimum of 2500 of earned income to claim the ACTC. Every child every chance. This tax credit is available so taxpayers can take advantage of the unused portion of the Child Tax Credit.

Additional Child Tax Credit. You claim this credit on Form 1040. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes.

Additional Child Tax Credit 2020 Income Limit. Then it phased out for income. Tackling child poverty delivery.

There are some qualifying rules and income matters. You claim this credit on form 1040. 112500 if filing as head of household.

Certain income limits will lower this credit amount. A salary of 200000 is comfortable for pretty much anyone but this updated credit. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

The maximum amount you can claim for the credit is 500 for each dependent who qualifies for the ODC. You can also contribute an extra 1000 if you are 50 or older. The Child Tax Credit and the Additional Child Tax Credit are meant to help working parents with low to moderate incomes.

For 2020 the maximum amount of the credit is 2000 per qualifying child. Withdrawal threshold rate 41. Making a contribution of just 4000 could get you the full credit.

The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. The Child Tax Credit is worth as much as 2000 for the 2020 tax year and up to 1400 of that can be refundable. So if youre looking to get the full Savers Credit you do not need to make the maximum contribution to a retirement account.

Like all tax credits the additional child tax credit works by reducing the amount of tax you owethe additional child credit is actually part of the child tax credit which was temporarily increased under the tax cuts and jobs act of 2017. For all other tax filing statuses the phaseout limit is 200000. Tax Policy Center.

Parents whose income comes solely from unearned income such. Earned income can come from salaries and wages self-employment and some disability payments. There are some qualifying rules and income matters.

For 2020 returns the ACTC is worth up to 1400. This credit is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or 1040-SR line 27. - The 2020 and 2021 child tax credit can reduce tax liability by 2000 per child amounting to a this differs from a tax deduction which reduces how much of your income is subject to income additional child tax credit actc.

The Additional Child Tax Credit is refundable which means you will receive the amount awarded in the form of a tax refund. The majority of the time it is equal to the unused portion of the Child Tax Credit up to 15 of your earned income that is more than 3000. Limited to 1400 per qualifying child.

You must have an earned income amount of at least 2500 in order to receive the Additional Child Tax Credit.

Irs Child Tax Credit Payments Start July 15

What To Know About New Child Tax Credits Starting In July Nbc 5 Dallas Fort Worth

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

What Is The Additional Child Tax Credit Turbotax Tax Tips Videos

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

500 Payment For Working Households On Tax Credits Low Incomes Tax Reform Group

Child Tax Credit Enhancements Under The American Rescue Plan Itep

Child Tax Credit Definition Taxedu Tax Foundation

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit What We Do Community Advocates

Child And Working Tax Credits Statistics Provisional Awards April 2021 Background And Definitions Document Gov Uk

Overpayments And Underpayments How Do Tax Credits Work Guidance Tax Credits

Child Tax Credit Definition Taxedu Tax Foundation

Five Facts About The New Advance Child Tax Credit

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Expanding The Earned Income Tax Credit Could Provide Financial Security For Millions Of Workers Without Children Urban Institute

Komentar